It is important to know if you need to have a loan agreement in place to protect you while lending any money to anyone or provide services without any payment. Without having an investment loan contract in place to ensure that you will be repaid, you never really want to loan out any money, goods, or services. The general purpose of an investment loan contract is to layout what is being loaned and when the borrower or lender has to pay it back along with the payment method.

spacestarters.com

File Format

microworld.org

File Format

inalco.com

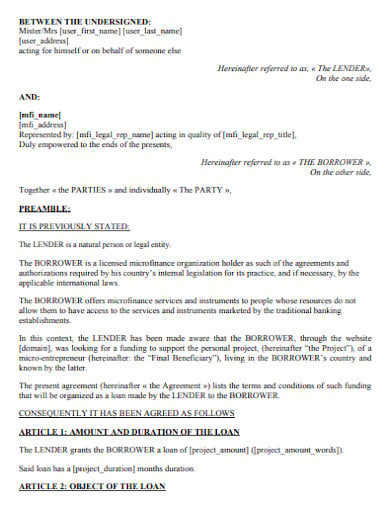

File FormatAn agreement that is a formal contract where the lender specifies the binding terms and conditions to which the borrowers must agree to receive a loan is termed as an investment loan agreement contract. This agreement also sets forth the amount of the loan, the borrower’s collateral, the repayment plan, term, and all the penalties like late fees in case the borrower defaults. A loan contract can be considered as a written agreement that is made between financial lenders and borrowers and where both parties sign the contract upon agreeing to the terms.

An agreement that is done between a business or a business owner and a lender or a lending bank is known as a business loan agreement. The loan is the amount of money that is borrowed by the borrowing business in exchange for security and other promises made by the borrower including a promissory note to repay. This agreement documents the promises of both parties that are involved which includes the promise by the lender who will pay the money and the promises by the borrower to repay that money within a specific date. A business loan agreement will have all the required provisions and clauses that are made to protect the bank and also the person taking the loan.